Industry: Financial Services, Real Estate

Overview: Our client was looking to build a proof-of-concept to demonstrate the tokenization of ownership of real estate, and ability to fractionalize said ownership of real property.

Challenge: Helios Energia, a Real Estate Investment Firm was exploring the idea of creating an application that demonstrated the ability to fractionalize ownership of real estate to lower the barrier of entry for investments.

Solutions: Utilize a Blockchain network to tokenize property within a portfolio so ownership can be easily verified, and fractionalized between several parties.

Technologies: Angular, Iconic, Hyperledger Fabric and Composer, Node JS, IBM Cloud Kubernetes container

Summary:

Helios Energia, a Real Estate Investment Firm approached TxMQ with an idea to fractionalize property ownership of an investment portfolio to lower the barrier of entry for potential investors. The idea is very similar to crowdfunding a product or service, but also creates an opportunity for real estate ownership for those who may not have the immediate capital or knowledge to invest on their own.

When the Helios team came to TxMQ, immediately it was identified that Blockchain would be a perfect match for their needs. This particular project required the property asset to be digitally tokenized so that ownership could be shared and verified in a secure trustless environment. The ability to tokenize assets is one of the main selling points for Blockchain adoption, and there are many new use cases that have been realized due to this unique feature.

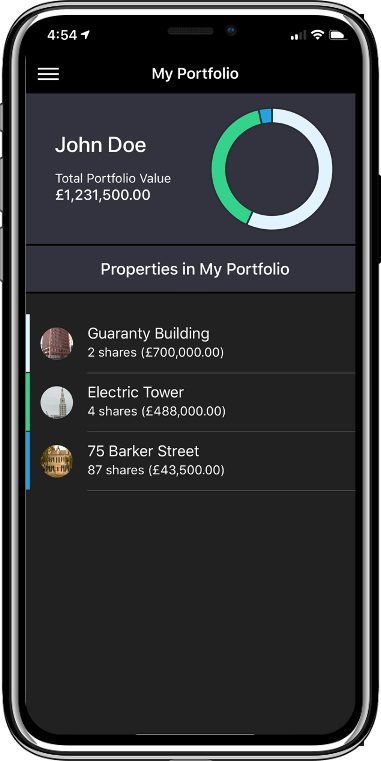

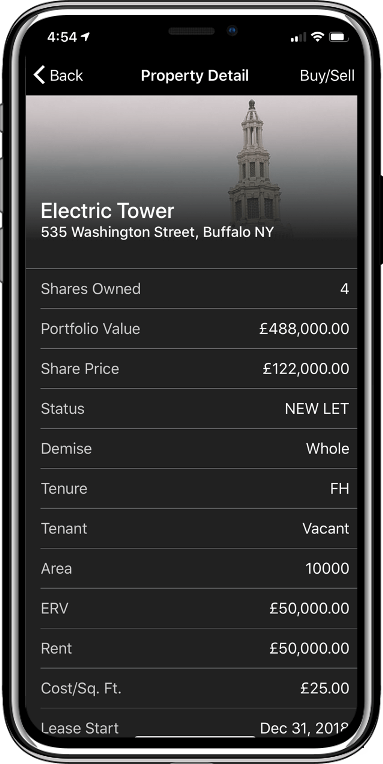

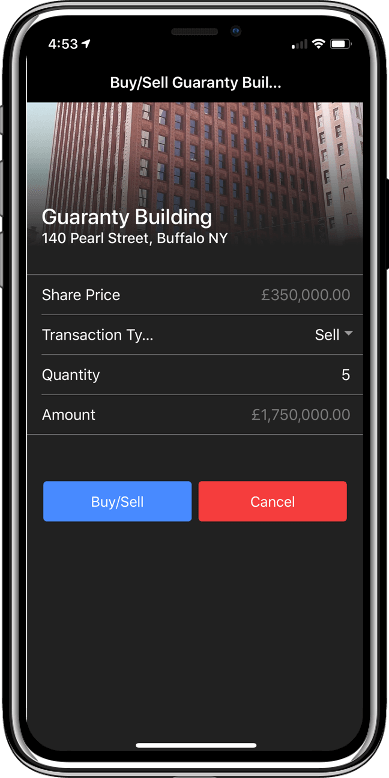

In this case we delivered a Proof-of-Concept that conceptually showed it was possible to tokenize assets on a Blockchain which opened up the opportunity to fractionalize these assets for ownership. TxMQ delivered a Kubernetes containerized application, available on mobile UX interface for ease of management, and visibility.

Screen Shots, and UX examples for Proof of Concept:

- Fractionalized Portfolio Holdings

- Property Detail Example

- Buy and Sell Property Example